When I tell people about my online solar investing start-up, Legends Solar, they commonly assume that I must have come from a professional service or consulting background. It takes specialized knowledge to create a product in finance and investing — so when I explain that my previous work was in product design and brand strategy, I sense skepticism.

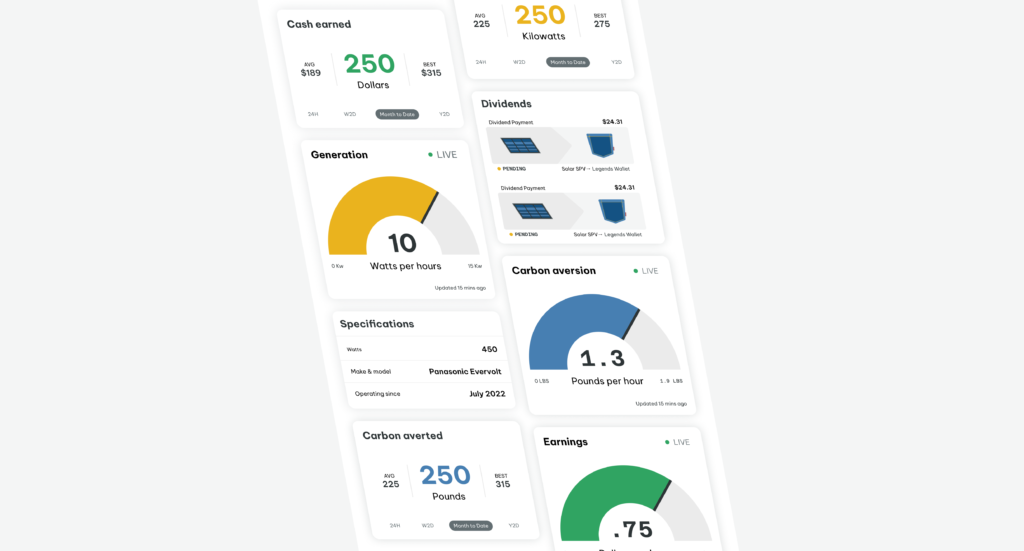

Legends Solar is an online investing platform that allows you to purchase operating solar panels on commercial solar facilities. You collect cash earnings as you generate and sell electricity to the grid. Importantly, we provide a dashboard of real-time data to our investors, so they can check in on their panels and monitor their electricity generation, cash earnings, and carbon impact.

I think about our work at Legends Solar redesigning financial security so that anyone can understand what change they are affecting when they make an investment. If I had an MBA instead of an MFA, Legends Solar would be a very different company — and probably worse for it. As a product designer, I obsess over what motivates people to engage with a product. Traditional founders of ‘fin-tech’ investment products fundamentally misunderstand what motivates people — and are ill-equipped to learn.

Mistaking your own problem for your customer’s

Many fin-tech startups claim to ‘democratize’ high finance by making investments that were once available only to the ‘ultra-wealthy elite’ accessible to everyday investors. Founders of these products imagine their users to be little tiny miniature hedge funds.

This is a gross misconception of how real people think about their financial choices – yet it is surprisingly widespread among fin-tech start-ups. Why do so many new businesses lean on a narrative that does not actually respond to their customer’s motivations? Typical start-up founders, who are often from the professional services industry like management consulting and banking, often think about their own financial lives this way – and manage their personal savings like a Wall Street trader. They imagine their customers to share this mindset, building, and marketing products that cater to it.

Design has allowed me to avoid that trap. Part of my experience and training is in human-centered design — an approach to qualitative research and interviewing well suited to understanding the true motives behind everyday decision-making. Through this process, I’ve learned that almost no one thinks about their financial lives in the terms that most fin-tech startups frame them — just the opposite.

Exploring real motivations with design research

Most people only have a vague idea of how their investments actually work. The financial system is endlessly complex, but people like to know what they own in their savings accounts. This is why the most commonly purchased stocks owned by individual brokerage accounts are companies that sell consumer products with household names.

Owning stock in a company whose products you purchase makes you feel like you are a real stakeholder in your investment — and it is that feeling that is absent in most consumer-saving products. The tools that ‘elite’ investors use introduce even more complexity and make investors even more distant as stakeholders in their own companies.

When I started prototyping Legends Solar, I knew responsible investing alternatives like ‘ESG’ index funds and impact-focused investments were gaining popularity. But it was not until I started a design research process that I understood why. Founder

It is commonly believed that customers of these products feel that they are making a financial sacrifice to invest in a more values-driven way. Many people want to do the right thing through their investment, but it is even more important to them to feel in control. They often find it unsettling that the contents of their 401(k)s and other savings accounts are so abstract and unknowable to them. Founder

Everyday investors understand that diversified savings accounts allow them to benefit from many companies’ cumulative growth and profits – but worry that they might benefit from business activities that violate their values. In recent years, the political donations of corporations and their executives have attracted negative headlines and stoked suspicions about the hidden role of corporations in government. The role of banks in creating the conditions for the financial crisis and of industrial corporations in creating environmental crises create further concerns.

Many people see ESG and impact investing as a way to opt out of investments that might make them feel complicit in these social ills. However, these products don’t really attack the problem at the root. An ESG index fund investor still owns tiny stakes in an unfathomable number of companies with operations far vaster than anyone could understand, let alone influence. Founder

This is the fundamental flaw that many fin-tech and responsible investing products share – people don’t want to be ‘active’ investors in the way that hedge funds are, and they don’t want to be ‘passive’ investors in the way that index funds make them. They want to be ‘engaged’ – they want to understand practically what they own and what their participation means.

Responding to real motivations with human-centered design

The idea of engaging users through experience and design is not new – although it is novel in the world of fin-tech investment products. Uber and Lyft use thoughtful design and beautiful data visualizations to create a sense of order and accountability that give riders a sense of security that was once reserved for car owners. When you see a birds-eye view of the fleet of vehicles available on a taxi app, you get a sense of control and ownership – as though the entire machinery of the ride-share apparatus were right under your thumb. Founder

The fundamental service provided by rideshare is not so different from what it replaced – get from point A to point B in a car with a driver. But the user experience of ride-sharing fostered a completely new set of behaviors that revolutionized transportation. People don’t like to be left in the dark, waiting for their ride to come with no indication of when it might arrive. Even if it takes longer, they often prefer rideshare for the sense of security that comes with having a real-time visualization of where your vehicle is and when you can expect to get home – for many, that’s what made rideshare an acceptable alternative to a car, and sometimes even preferable.

Some alternative investment products claim to put the investor in control but do so only in a cosmetic sense. Robinhood makes it easier than ever to buy and sell securities, and ESG attempts to ameliorate the ethical ambiguities of investing – but the actual organizations, machinery, and products those securities represent remain as abstract and distant as ever.

How Much Money Should I Save Before Changing the Job?(Opens in a new browser tab)

Starting a journey with the tools of design

The journey of designing Legends Solar is to create a product that genuinely responds to the actual motivators that draw people into alternative investing. Our first product, online solar investing, allows you to invest ‘by-the-panel’ and monitor your real-time impact and earnings, is just the first station in that journey. Over time, we plan to introduce more features that do what Airbnb did for hospitality and what Uber did for transportation.

My background in product design has given me a solid foundation to point the ship forward. Every day we share prototypes with real users and explore individuals’ perceptions of their personal savings in the context of design research. Getting my hands dirty in the prototyping process allows me to push forward new ideas swiftly and with high fidelity and resolution, even though we are still a small team.

I take inspiration from past MFA founder designers like Brian Chesky and the team at Airbnb. Their example not only gave me the confidence to create Legends Solar – it helped me decide to earn a Master of Fine Arts in the first place. As I’ve grappled with the trials of forming a startup, I’ve come to appreciate the determination and skills required of any successful founder. And to be honest, very few people can navigate the ambiguity involved – not just in the fine arts, but in any discipline.

I hope that in the future, more MFA’s choose a path of entrepreneurship – and that ambitious young people with an entrepreneurial streak don’t shy away from the arts because they fear they might be marginalized by industries that misunderstand and underestimate the power of design. Though Legends Solar is still in an early stage, my ambition is for it to become a vehicle that can bring a true design ethic to an industry that has resisted it for too long. A design mindset allows you to see problems from a perspective invisible from other vantage points – and designers can leverage that to make great products that change the world.

By Lassor Feasley, Co-Founder + CEO of Legends Solar